Crude Trends Fueling Prices and the Energy Market

May 09, 2025

By Michael Nigro, GCC Energy Risk & Pricing Analyst

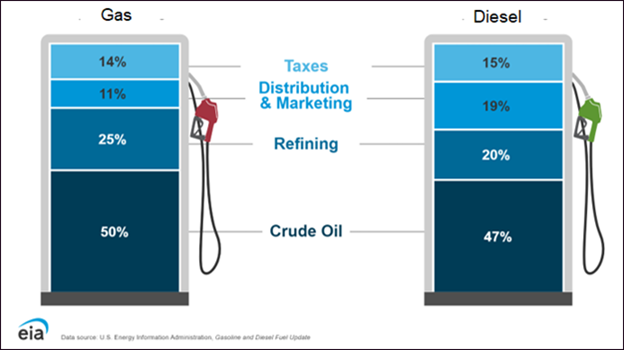

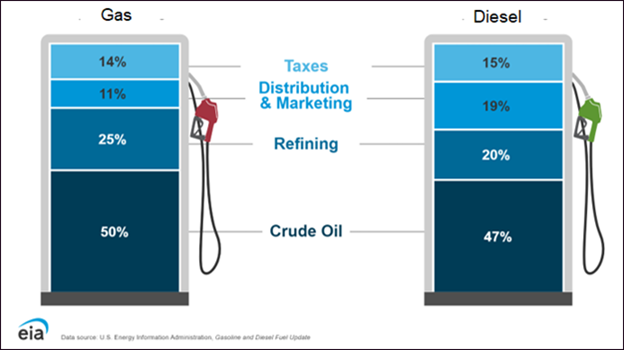

If you’ve ever wondered what goes into the fuel prices we pay at the pump, you may have seen a breakdown like the one below.

This visual is a helpful reminder that crude oil prices are the single largest factor in determining the cost of fuel—whether at the retail pump or in the bulk deliveries provided by the GCC Energy Division.

We’ve previously shared that crude oil prices are influenced by a wide range of factors, including (but not limited to) the global economy, geopolitical conflicts, production and supply reports, shifting energy trends, and news headlines.

The good news for buyers right now is that prices have dropped to levels not seen since the post-COVID recovery. As of this writing, diesel and gasoline prices are sitting at four-year lows, and the bearish forces behind this trend don’t appear to be easing any time soon.

A Trump victory in the U.S. Presidential Election was expected to benefit energy markets by pushing consumer prices lower—and we’re already seeing signs of that. Currently, tariff discussions are dominating the news and weighing heavily on global economic outlooks and demand projections for petroleum products.

That said, it’s worth noting that domestic fuel inventories are also at five-year lows. When crude prices drop significantly, it often leads to reduced investment and production from suppliers. Historically, this sets the stage for a future market rebound.

At GCC, we’re constantly monitoring market conditions and are always happy to share insights with members who want to dive deeper. If you're interested in discussing product options, contracts, or have questions about the energy markets, feel free to call our Petroleum Office at (620) 276-8301 or email us at petrodispatch@gccoop.com.

If you’ve ever wondered what goes into the fuel prices we pay at the pump, you may have seen a breakdown like the one below.

This visual is a helpful reminder that crude oil prices are the single largest factor in determining the cost of fuel—whether at the retail pump or in the bulk deliveries provided by the GCC Energy Division.

We’ve previously shared that crude oil prices are influenced by a wide range of factors, including (but not limited to) the global economy, geopolitical conflicts, production and supply reports, shifting energy trends, and news headlines.

The good news for buyers right now is that prices have dropped to levels not seen since the post-COVID recovery. As of this writing, diesel and gasoline prices are sitting at four-year lows, and the bearish forces behind this trend don’t appear to be easing any time soon.

A Trump victory in the U.S. Presidential Election was expected to benefit energy markets by pushing consumer prices lower—and we’re already seeing signs of that. Currently, tariff discussions are dominating the news and weighing heavily on global economic outlooks and demand projections for petroleum products.

That said, it’s worth noting that domestic fuel inventories are also at five-year lows. When crude prices drop significantly, it often leads to reduced investment and production from suppliers. Historically, this sets the stage for a future market rebound.

At GCC, we’re constantly monitoring market conditions and are always happy to share insights with members who want to dive deeper. If you're interested in discussing product options, contracts, or have questions about the energy markets, feel free to call our Petroleum Office at (620) 276-8301 or email us at petrodispatch@gccoop.com.